What is a Health Share and Why is it a Bad Idea?

We detail why Health Shares don’t, can’t and won’t save healthcare

Introduction

Normally we talk about healthcare and health insurance in this space and today is not different. Today we are going to discuss Health Shares, how they pertain to health insurance and why they are an exceedingly bad idea.

What is a Health Share

From Ramsey Solutions:

A health share plan is a type of health care support that lets you:

- Opt out of certain services you’d have to pay for (but would never use) if you bought the more expensive traditional health insurance

- Save lots of money on membership costs because you’re only buying a basic list of services than what’s packaged in typical health insurance

What we glean from this is that a Health Share IS traditional health insurance that isn't offered by an insurance company and that doesn’t cover some things. Most of these things are ones that conflict with religious beliefs.

Danger Will Robinson.

Outside of that, it is just risk sharing, which is exactly what traditional insurance does.

Why is that Bad?

Religion

First, you have a bunch of religious guys that may or may not align with your beliefs in control of your healthcare. We aren’t conflating healthcare with health insurance. If your insurance company isn’t paying for your procedure, you probably aren’t getting it. I don’t know about any of you, but I want the church out of my government and my wallet. As far as we can tell, all the Health Share companies have some religious association. They might decide that you should be best treated by being bitten by a rattle snake as going to the hospital.

This is science, “belief” has no business being here.

This is business and religious organizations are disallowed from being here.

Otherwise, we should just tax religious organizations the same way every other business is being taxed.

“But they aren’t profit motivated,” you say. Neither is Blue Cross/Blue Shield. How is that working out for their covered population?

There is Nothing new under the Sun

We are still talking about traditional insurance, outside of someone telling you what is and isn’t covered. There are still all the old legacy insurance tricks.

Insurance Networks

There are still all the old tricks to limit care like networks. Your doctor may not accept this insurance. We proved that networks are intended to raise impediments to care by limiting choices for patients to doctors “in network” only.

Medical Coding

Your doctor still has to employ staff to translate medicine into ‘codes’ your insurance company Health Share can understand. This is a huge unnecessary expense for doctors and increases the cost of your care.

Pre-Authorization

This is the same old trick that the legacy insurance carriers use to get you to give up on obtaining care. The only difference is that the Health Share has to consult the invisible man in the sky who loves you and wants you to be happy before authorizing care.

Adjudication

Your Health Share can just deny your coverage, the same way the big legacy carriers do. In fact, because they basically are big legacy carriers, they have to in order to keep expenses in check.

Denials

Adjudication isn't necessary unless you plan on denying care. This is absolutely no different from the insurance you have now. United Health just blanket denies about ⅓ of all claims. They are hoping that you won’t resubmit and that you will just go away without making them pay. What recourse do you have when your Health Share does the same thing?

Verification

Your doctor has to know they are getting paid, so they have to either call, fax or visit your insurance company's website to verify your coverage for any given procedure. Some practices and hospitals have applications that query a clearinghouse for that information but those applications are notoriously unreliable and expensive.

Rate Negotiations

The heart of insurance like a Health Share is rate negotiations. Your doctor has to quite literally waste his time with an insurance company attorney trying to get him to accept less for his or her work, every year. This is why you see some of the bigger hospital systems just not accepting your insurance periodically. Some dumb attorney won’t pay for the services your doctor provides.

Delays

Your insurance company keeps your premium in a large pool with everyone else’s. When you get care, the payment comes out of that pool. The problem is that the companies earn interest on the pool. Insurance companies (and Health Shares) delay payment of claims so they can earn more interest. This causes your doctor to charge more in order to finance the contractually obligated payment for your procedure, increasing costs for everyone.

Sales/Brokers/Agents

You still have to call your Health Share and order your coverage. These calls are answered by people who get paid to do what they do. That is fine, everyone needs to get paid, but this is a job that doesn’t need to be done. Further, I am pretty sure that you know as much about insurance as any average wandering salesman. A salesman that you are paying.

General Monkey Motion

Everything that your Health Share, or insurance company does that is not “pay for your healthcare” is wasted motion. You don’t need people to run an insurance company. An insurance company is really just a bank that only pays your doctor. When was the last time you visited a brick and mortar bank? When was the last time you physically laid eyes on your insurance agent, if ever? When was the last time you talked to anyone at your insurance company except for “yes you are paying?”

Facilities

All of the people that work at the insurance company or Health Share that we talked about in “General Monkey Motion” have to have a place to be. Buildings in every major city. Air conditioning, computers, networks, desks, chairs, management, more management. More management. Doctors that work for the insurance company to validate that your procedure is not medically necessary. The only thing all those people do is deny coverage. They all have to have a place to work. 140,000 of them At United Healthcare. Your Health Share has to have some proportionate number at their facilities, too

Great, But What is the Solution?

Sentia has automated this entire process. We provide the Electronic Medical Record (EMR) to the practice or hospital, and pay for procedures performed in real time. The doctor documents your care. As s/he selects procedures, the covered procedures come up in green with a dollar amount. The practitioner selected the appropriate procedures and payment is transferred to the practice in real time.

Read that again.

That automates not only the entire health insurance industry, it replaces Epic and Oracle/Cerner and everyone else with a real, valid, patient documentation system as well, not a glorified billing system.

Sentia pays a reference-based price, we recommend 150% of Medicare, adjusted as necessary, eliminating medical networks and negotiations. Your practitioner can take or leave the payment.

Sentia also eliminates the need for a third party Medical Records system. One Epic installation recently, at Northwell documented a $1.2 BILLION cost. You, the patient, pays for that. With Sentia we charge the doctors and nurses the same $10/month we charge the patients to use the system.

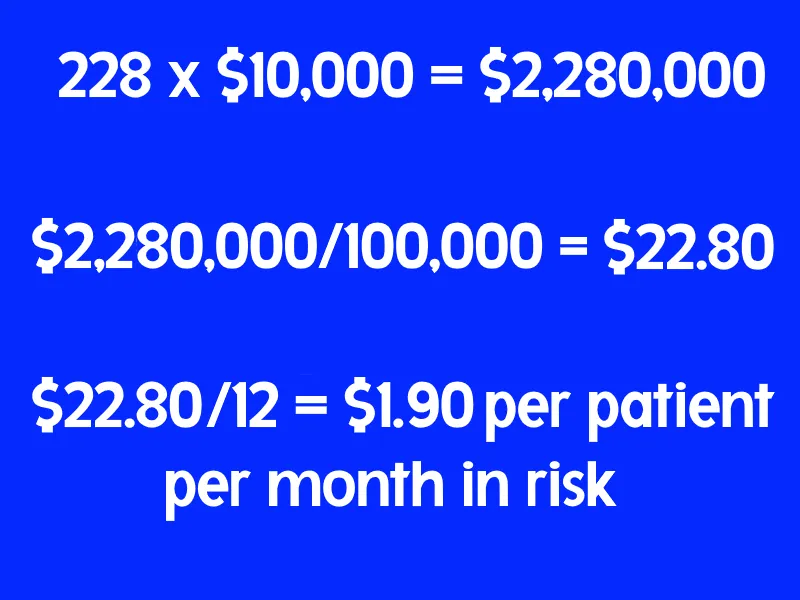

Speaking of costs, Sentia charges the patient $10/month to manage the data, plus the risk. Don’t let your eyes glaze over, this is easy. Let’s consider a fairly major surgery, an appendectomy. An open appendectomy on average costs about $5,000 and a laparoscopic appendectomy costs about $15,000. Let’s average those for the purpose of discussion and simplicity to $10,000. Your chances of needing an appendectomy are 228 per 100,000 patients. Multiply the cost of the procedure by the chances of needing it and divide by the population, then divide by the number of months in a year and you have a risk cost per patient per month.

Like this:

That major surgery incurs a cost of $1.90/month on average. We do that for all the covered procedures in your policy and add $10/month for the privilege of managing your data and that is what you pay. The cost of the risk is broken up into ten year tranches, or sections, so the 20 somethings are not financing the rest of us, but besides that, it is pretty simple.

That makes everything not only automated, but transparent as well. You know exactly what each covered procedure costs, and what the risk is per month as well.

Conclusions

Health Shares are just more of the same, manual, wasteful process that your legacy insurance company already charges you to do, except there is some guy there yelling “The invisible man in the sky says you don’t need or can't have the procedure your doctor prescribed.”

Sure the Health Share removes the profit motive (maybe, or maybe not) but Blue Cross/Blue Shield is non-profit too, and they are just as expensive as any other big insurance company.

The only way to solve the healthcare finance crisis in the United States is to automate the entire process. That eliminates both the big billing systems like Epic and Oracle/Cerner, and the big wasteful insurance companies as well.

Sentia can actually write a connector to Epic or anyone else, but that only solves part of the problem. It still requires the billing system and medical coding to input it into our system for automatic payment. Epic and every other vendor on the planet use language to document patient care. They type in English (or whatever language) to describe whatever it is they do and that has to go to another employee to decode. Our system does away with all that. We use discrete values to document patient care. That also gives us the ability to relate symptoms to diagnoses to treatments to outcomes. Read more about that here.

Even all that only solves part of the problem. 84% of medical spending in the US is attributed to behavior-based, avoidable, chronic disease. Senia’s solution includes a Health and Wellness module that automatically detects anomalies in lab results and clinical measurements and prescribes patient education based on those anomalies. That means it figures out what is wrong with your behavior and then teaches you how to fix it, so you don’t have these behavior-based illnesses that cost you and the rest of us that 84%. When your lab results improve, because you followed the education, you get a 15% discount. If you don’t improve, you don’t get the discount. The non-discount is cumulative, year over year, so eventually not changing unhealthy behavior will result in our insurance NOT being cheaper for you and forcing you to find another carrier to keep costs low for the rest of us. Read a detailed analysis of this system here.

Also, we don’t care who pays the $10 plus the risk. It could be the patient, it could be the patient’s employer, it could be the government. We just don’t care. This isn't dependent on anyone doing anything any differently than they are now, except of course the big EMR vendors and the big insurance companies, and they both just need to go away.

We estimate that automating the entire health insurance industry will save us half from the cost of health coverage. Note that we say coverage not insurance. Further, getting the US down to the OECD mortality levels of behavior-based, avoidable chronic disease will have about half or the rest.

That means a 50% reduction in cost now, and 75% eventually.

We have this system designed and deployed and ready to help.

We have built a comprehensive health information system to keep the patient healthy and on the right track with the ability to incentivize healthy living. This system includes the automation of the health insurance industry completely, eliminating more than half the costs by direct payments to doctors and practices, and half the remainder by keeping patients healthy.

Here are some points detailing the costs incurred by the legacy insurance companies that you pay currently, according to Grand View Research and current as of 2023 and that Sentia would eliminate completely:

Medical Records:

- The average practitioner spends $35,925 annually on electronic medical records

- The average patient spends $106 annually on electronic medical records

- The average patient encounter or visit cost for electronic medical records alone is $32

Medical Coding:

- The average practitioner spends $20,286 annually on medical coding

- The average patient spends $60 annually on medical coding

- The average patient encounter or visit cost for medical coding alone is $18

Compliance and Efficacy Reporting:

- The average practitioner spends $17,165 annually on compliance and efficacy reporting

- The average patient spends $51 annually on compliance and efficacy reporting

- The average patient encounter or visit cost for compliance and efficacy reporting alone is $15

Totals:

- The average practitioner spends $73,376 annually on completely avoidable costs

- The average patient spends $217 annually on completely avoidable costs

- The average patient encounter or visit cost for completely avoidable costs alone is $66

Yes, you read that correctly $66 per visit. There must be a better way. There is a better way and Sentia has it. Remember also that these costs are over and above the 50%+ your insurance company wastes or shoves into their pockets.

We have also designed and are building an ERP style practice/hospital management system that will pinpoint and eliminate cash leaks and inefficiencies in enterprise medical facilities. Implementing this system should be fairly simple and will completely revolutionize the way healthcare is delivered and paid for, saving countless lives. We have shown a way to use this system to make the best healthcare system in the world also the most efficacious and the most affordable.

If you liked what you read contact us here, on our site, SentiaHealth.com, our parent company SentiaSystems.com, or send us an email to info@sentiasystems.com or info@sentiahealth.com.

Comment

| Date Written | Comment |

|---|